Using Dollar Cost Averaging in Ghana is a simple and effective investment strategy that can help you reduce your risk and maximize your returns. Learn how to use DCA to invest in Ghana with this comprehensive guide.

Investing in Ghana’s financial markets can be both exciting and challenging. Whether you’re a seasoned investor or just starting, you may have heard about Dollar Cost Averaging (DCA) as a strategy to navigate the often unpredictable world of investments.

In this guide, we will delve into the specifics of DCA in Ghana and how it can be a valuable tool for Ghanaian investors.

Understanding Dollar Cost Averaging

Demystifying DCA

Dollar Cost Averaging is a simple investment strategy that involves consistently buying a fixed dollar amount of a particular asset at regular intervals, regardless of its price. This approach is in stark contrast to lump-sum investing, where you invest a large sum all at once.

The Psychology Behind DCA

One of the primary reasons DCA is effective is its ability to mitigate the impact of market volatility. By investing a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high.

Over time, this can lead to a lower average price per share and reduced exposure to market fluctuations.

Dollar Cost Averaging in Ghana

Now, let’s apply the concept of DCA to the Ghanaian context. In Ghana, as in many other countries, the financial markets can experience significant ups and downs. DCA can be a particularly valuable strategy for local investors looking to build wealth steadily over time.

How to Implement Dollar Cost Averaging in Ghana

Getting Started

Implementing a Dollar Cost Averaging strategy in Ghana is a straightforward process, but it requires careful planning and commitment. Here’s a step-by-step guide to help you get started:

- Set Clear Financial Goals: Before you begin, it’s essential to define your financial objectives. Are you saving for retirement, building an emergency fund, or working towards a specific financial milestone? Knowing your goals will help determine the amount you need to invest and your investment horizon.

- Assess Your Financial Capacity: Evaluate your financial situation to determine how much you can comfortably invest on a regular basis. Consider your monthly income, expenses, and any other financial obligations. Be realistic about what you can afford to invest consistently.

- Select Your Investment Assets: Depending on your goals and risk tolerance, choose the assets you want to invest in. In Ghana, common investment options include stocks, bonds, mutual funds, and real estate. Research each asset class to understand its potential returns and risks.

- Choose a Reliable Financial Institution: You’ll need to open an investment account with a reputable financial institution or brokerage firm in Ghana. Consider factors such as fees, available investment options, customer service, and the ease of using their online platform. This decision is crucial, as it will be the vehicle through which you execute your DCA strategy.

- Determine the Investment Amount: Based on your financial capacity and investment goals, decide on the fixed amount you’ll invest during each contribution period. For example, you might choose to invest 200 GHS every month. You can use DCA even if you don’t have a large sum of money to invest.

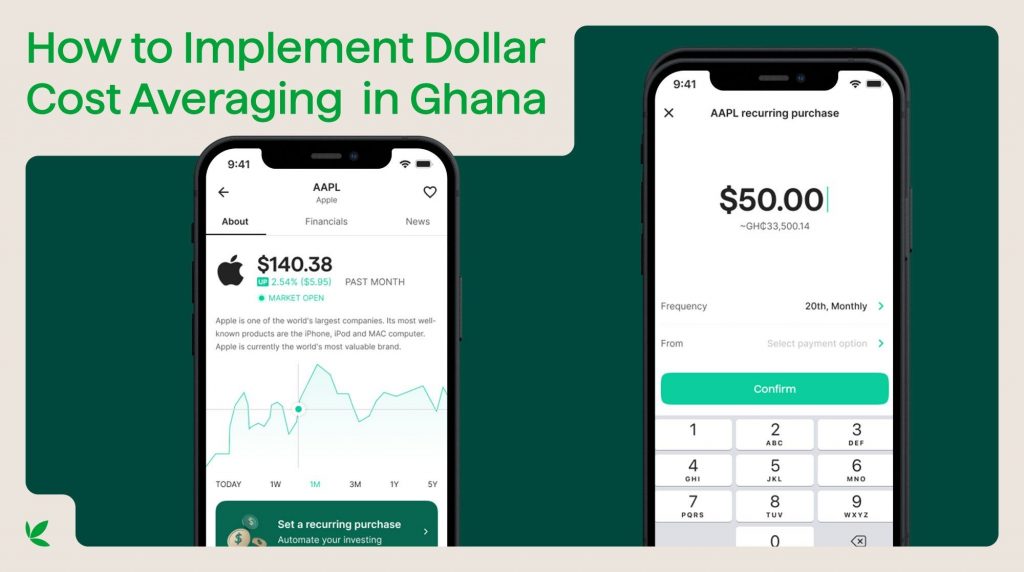

- Set Up Automatic Transfers: To ensure consistency in your DCA strategy, consider setting up automatic transfers from your bank account to your investment account. Many financial institutions offer this feature, allowing you to automate your investments on a schedule that suits you, whether it’s monthly, quarterly, or any other frequency.

- Stay Informed: Keep yourself updated about the performance of your chosen investments and any changes in the financial markets. While DCA is a long-term strategy, it’s essential to periodically review your portfolio to ensure it aligns with your goals.

Selecting the Right Investments For Dollar Cost Averaging

When selecting the right investments for your DCA strategy in Ghana, it’s crucial to consider various factors:

- Risk Tolerance: Assess your risk tolerance, which is your willingness and ability to withstand market fluctuations. Investments with higher potential returns often come with higher levels of risk. Ensure that your chosen assets align with your risk tolerance.

- Diversification: Diversifying your portfolio means spreading your investments across different asset classes and sectors. This can help reduce risk by not putting all your eggs in one basket. In Ghana, consider diversifying between stocks, bonds, and other assets.

- Investment Horizon: Your investment horizon refers to the length of time you plan to hold your investments. The longer your horizon, the more risk you may be able to take. If you’re investing for retirement, for instance, your horizon may be several decades.

- Research and Due Diligence: Before making any investment, conduct thorough research on the assets you plan to include in your portfolio. Analyze historical performance, company fundamentals (for stocks), and economic indicators that may impact your investments.

- Seek Professional Advice: If you’re uncertain about your investment choices, consider consulting a financial advisor in Ghana. A qualified advisor can provide personalized recommendations based on your financial goals and risk tolerance.

Setting Up Accounts

Opening the right accounts is a critical step in implementing your DCA strategy:

- Brokerage Accounts: If you plan to invest in stocks or exchange-traded funds (ETFs), you’ll need a brokerage account. Choose a brokerage firm in Ghana that offers the assets you’re interested in and provides a user-friendly platform for trading.

- Bank Accounts: For investments in government bonds or mutual funds, you’ll typically need a bank account. Many Ghanaian banks offer investment accounts that facilitate transfers to your chosen investment vehicles.

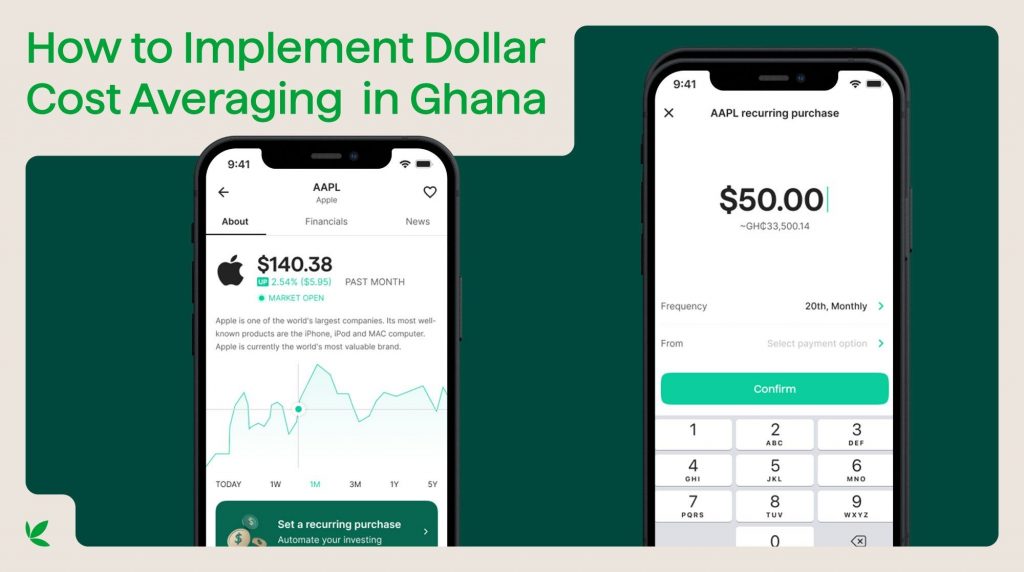

- Online Platforms: Consider using online investment platforms in Ghana that provide easy access to a wide range of investment options. A top investment platform used by Ghanaians in Bamboo.

Bamboo offers a user-friendly experience for investors and provides additional tools and resources for automatic dollar cost averaging.

You can download the Bamboo Investment app from the Play Store. If you are an iPhone user, you can also download the Bamboo investment app from the App Store.

- Documentation: Be prepared to provide the necessary documentation when opening accounts. Commonly required documents include identification (such as a Ghanaian national ID card or passport) and address verification (utility bills or other official documents).

Implementing a Dollar Cost Averaging strategy in Ghana involves setting clear financial goals, assessing your financial capacity, selecting the right investments, choosing a reliable financial institution, setting up automatic transfers, and staying informed about your portfolio’s performance.

By following these steps and considering your unique financial situation, you can embark on a successful DCA journey in the Ghanaian investment landscape.

How To Set Up Dollar Cost Averaging on Bamboo For Ghanains

Dollar Cost Averaging Strategies in Ghana

Market Timing vs. DCA

One of the perennial debates in the world of investing is whether to engage in market timing or stick with the steady path of Dollar Cost Averaging.

In Ghana, where markets can exhibit considerable volatility, understanding the nuances of these approaches is essential for advanced investors.

Market Timing: This strategy involves attempting to predict market movements to buy assets when prices are low and sell when they are high. While it sounds promising, market timing is notoriously challenging and risky. Even seasoned investors struggle to consistently time the market accurately.

In Ghana, market timing can be particularly tricky due to the unpredictable nature of local financial markets. Rapid changes in economic conditions, geopolitical events, and other factors can lead to unexpected price fluctuations. Advanced investors may choose to incorporate some market timing elements but should do so cautiously and with a deep understanding of the risks involved.

DCA in Volatile Markets: On the other hand, DCA provides a disciplined approach to investing in the midst of market volatility. Advanced investors in Ghana often appreciate the stability and long-term perspective that DCA offers.

DCA helps mitigate the stress and risks associated with trying to time the market accurately. Instead of making emotional investment decisions based on short-term market movements, advanced investors can rely on a predetermined schedule of contributions. This approach allows for a more methodical and less emotionally charged investment journey.

Dollar Cost Averaging in Ghanaian Cedis

While DCA is often associated with investing in foreign currencies, such as the US Dollar or Euro, it’s important to recognize that you can effectively implement DCA in Ghanaian Cedis (GHS). This localized approach offers several advantages:

Currency Familiarity: Investing in GHS can be more comfortable for Ghanaian investors who are more accustomed to their local currency. It eliminates the need for currency exchange and simplifies tracking investments.

Reduced Currency Risk: When you invest in foreign assets using DCA, you are exposed to currency exchange rate fluctuations. Investing in GHS eliminates this risk, making your investment journey more predictable.

Access to Local Markets: Ghana’s financial markets offer a range of investment opportunities in GHS. Investors can explore options such as the Ghana Stock Exchange (GSE), GHS-denominated bonds, or mutual funds that operate in GHS.

It’s crucial to research and understand the GHS-denominated investment options available and their associated risks. Diversification across different asset classes and sectors in the Ghanaian market can help spread risk and potentially enhance returns.

Tax Implications of Dollar Cost Averaging

Advanced investors in Ghana should also be mindful of the tax implications of their DCA strategy. While DCA is generally tax-efficient, specific tax considerations can vary depending on the types of investments you hold.

For example, the taxation of capital gains, dividends, and interest income may differ between asset classes. Additionally, certain investment incentives or tax breaks may apply to specific investment instruments in Ghana. To optimize your DCA strategy from a tax perspective, consider seeking guidance from a qualified tax professional who is familiar with Ghana’s tax laws and regulations.

Implementing DCA strategies in Ghana require a deep understanding of the local financial landscape, a measured approach to market timing, and a consideration of the tax implications. By combining these elements, advanced investors can enhance their DCA strategy to achieve their financial goals while navigating the unique challenges and opportunities presented by the Ghanaian market.

Lessons Learned

From these stories, we can draw several valuable lessons. Patience, discipline, and a long-term perspective are key to reaping the benefits of DCA in Ghana’s dynamic financial environment.

Investing in Ghana with Dollar Cost Averaging

Ghana offers a dynamic and evolving investment landscape with various opportunities for both local and international investors. While the financial markets in Ghana can be rewarding, they also come with their unique set of challenges. Dollar Cost Averaging (DCA) is a well-suited strategy for navigating these markets effectively.

Ghana’s Investment Landscape

Before diving into DCA, it’s essential to understand the diverse range of investment options available in Ghana for Ghanians:

- Ghana Stock Exchange (GSE):

The GSE provides opportunities to invest in shares of Ghanaian companies. It’s a platform where businesses list their stocks, allowing investors to buy and sell shares in these companies. The GSE is a primary destination for those interested in equities.

- US Stocks and ETFs:

Investing in US stocks and ETFs can be a good way for Ghanaians to diversify their portfolios and gain exposure to the world’s largest and most diversified stock market.

US stocks have historically outperformed stocks from other countries over the long term. Ghanaians can invest in US stocks and also invest in US ETFs through investment platforms like Bamboo.

Bamboo makes it easy and convenient for Ghanaians to access and invest in the US stock market using dollar cost averaging.

- Government Bonds:

The Ghanaian government issues bonds as a means of raising funds for various projects and budgetary needs. Government bonds are considered relatively low-risk investments and can offer competitive interest rates.

- Mutual Funds:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, including stocks, bonds, and other securities. They are managed by professional fund managers and offer diversification without requiring individual investors to manage individual assets.

- Real Estate:

Investing in real estate, whether directly or through Real Estate Investment Trusts (REITs), can be a viable option for long-term wealth creation. Ghana’s real estate market has seen growth in recent years, making it an attractive asset class.

- Fixed Deposit Accounts:

Many Ghanaian banks offer fixed deposit accounts with competitive interest rates. These accounts provide a safe and predictable way to grow your savings.

Risk and Reward

Investing in Ghana, like any other market, comes with its own set of risks and potential rewards. Understanding these factors is crucial when implementing a DCA strategy:

- Market Volatility: Ghana’s financial markets can be volatile, and prices of assets may experience significant fluctuations. DCA helps mitigate this volatility by spreading your investments over time.

- Currency Risk: If you choose to invest in foreign assets, you’ll be exposed to currency exchange rate fluctuations. For example, if you invest in U.S. stocks, the performance of the Ghanaian Cedi (GHS) against the U.S. Dollar (USD) can impact your returns. Consider this when deciding on your asset allocation.

- Economic Factors: Keep an eye on local economic conditions and developments. Factors like inflation rates, GDP growth, and government policies can influence the performance of your investments in Ghana.

- Diversification: Diversifying your portfolio across different asset classes and sectors can help spread risk. This approach can reduce the impact of poor performance in one area while potentially benefiting from strong performance in another.

DCA in Ghana: A Steady Approach

DCA is particularly well-suited for the Ghanaian investment landscape, given its ability to provide a steady and disciplined approach to investing. Here’s how DCA can benefit investors in Ghana:

- Mitigating Volatility: Ghana’s financial markets are known for their volatility. By investing a fixed amount at regular intervals, you buy more shares when prices are low and fewer when prices are high. Over time, this can result in a lower average cost per share and reduce your exposure to market swings.

- Cedis Devaluation: This is a primary reason for Ghanaian investors to use a dollar cost averaging strategy because it can help you to reduce your risk and average out your investment purchase price over time.

For example, if a Ghanaian investor wants to invest in US stocks, they could use a dollar cost averaging strategy by investing $100 every month. This way, they would buy more stocks when the cedi is strong and fewer stocks when the cedi is weak. Over time, this would average out their purchase price and reduce their risk.

- Steady Accumulation: DCA enables investors to accumulate assets gradually. This can be advantageous for those with limited capital who want to build their investment portfolio over time.

- Long-Term Perspective: Investing with DCA encourages a long-term mindset. Instead of trying to time the market or react to short-term fluctuations, investors can focus on their financial goals and steadily work towards achieving them.

- Reduced Emotional Decision-Making: Emotional decisions can lead to impulsive actions that may negatively impact investments. DCA helps eliminate emotional reactions to market events, as investments are made according to a predetermined schedule.

- Tax Efficiency: DCA is often tax-efficient, particularly in markets like Ghana. By avoiding large lump-sum investments, you may reduce the tax implications associated with capital gains.

FAQs – Dollar Cost Averaging in Ghana

1. What is DCA, and how does it work in Ghana?

Dollar Cost Averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of the asset’s price. In Ghana, DCA operates in the same way as in other countries. You choose a specific amount to invest, such as 200 GHS, and a regular schedule, like monthly or quarterly. With each contribution, you purchase more shares or units when prices are low and fewer when prices are high, ultimately lowering your average purchase cost over time.

2. Can I practice Dollar Cost Averaging with a small budget in Ghana?

Yes, one of the strengths of DCA is its accessibility. Dollar cost averaging can be used by you even it you don’t have large sums to invest. Whether you have a small budget or a larger one, DCA can be adapted to suit your financial capacity. You can start with an amount that you are comfortable investing consistently. Even a modest sum, such as 50 GHS per month, can accumulate over time and yield substantial returns.

3. Are there tax advantages to DCA for Ghanaians?

DCA can offer certain tax advantages in Ghana, particularly if you are investing in tax-efficient vehicles like government bonds or tax-exempt savings accounts. However, the specific tax benefits can vary based on the type of investments you hold and your overall financial situation. It’s advisable to consult with a qualified tax expert in Ghana who can provide personalized guidance on how to optimize your DCA strategy for tax efficiency.

4. Is Dollar Cost Averaging suitable for retirement planning in Ghana?

Absolutely, Dollar Cost Averaging can be a highly suitable strategy for retirement planning in Ghana. By consistently investing a portion of your income over the years, you can build a substantial retirement nest egg. The disciplined nature of DCA ensures that you are making regular contributions towards your retirement goals, which is essential for long-term financial security.

Dollar Cost Averaging in Ghana: Conclusion

Dollar Cost Averaging is a versatile and accessible strategy for investors in Ghana. It offers a disciplined approach to building wealth over time and can be adapted to suit various budgets and financial goals. However, it’s essential to consider your individual financial circumstances and investment objectives when deciding whether DCA is the right strategy for you in the Ghanaian market.

Investing in Ghana with DCA offers a reliable and disciplined approach to navigating the country’s dynamic financial markets.

By understanding the available investment options, assessing the associated risks, and leveraging DCA’s benefits, investors can work towards achieving their financial goals while building wealth steadily over time in the Ghanaian context.

Bamboo is a top investment platform used by Ghanaians for investing. Ghanaians prefer Bamboo because Bamboo offers a user-friendly experience for investors and provides additional tools for implementing automatic dollar cost averaging.

You can download the Bamboo Investment app from the Play Store. If you are an iPhone user, you can also download the Bamboo investment app from the App Store.

Download now to begin your investment journey.