Investing in stocks can be an exciting way to grow your money over time, and with the help of apps like Bamboo, it’s easier than ever to start building your investment portfolio. But when it comes to choosing the right stocks to invest in, you’re often faced with a common dilemma: should you go for small-cap stocks or large-cap stocks? Don’t worry; in this article, we’ll break down the differences and help you make an informed decision.

What’s the Difference between Small-Cap vs. Large-Cap?

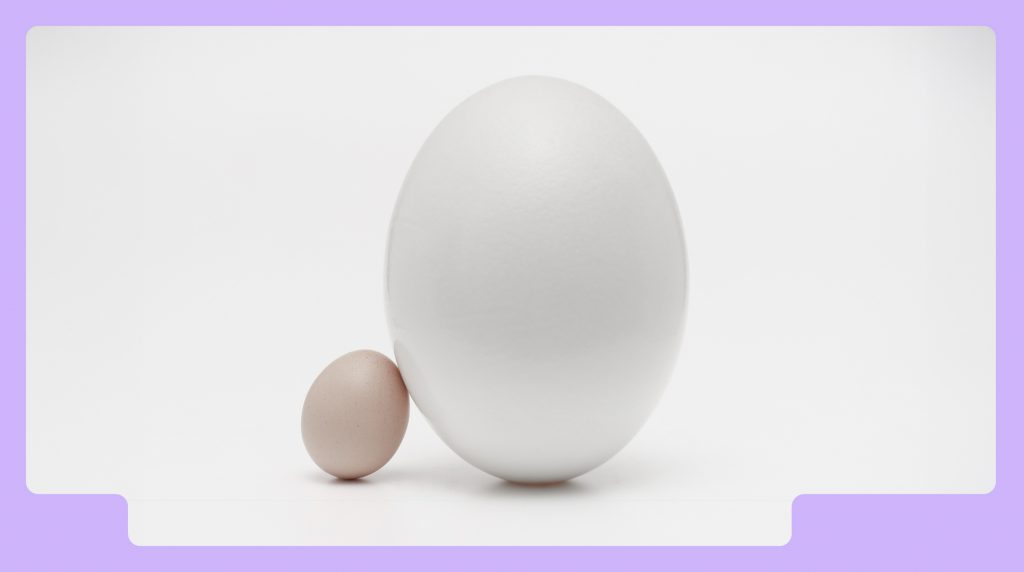

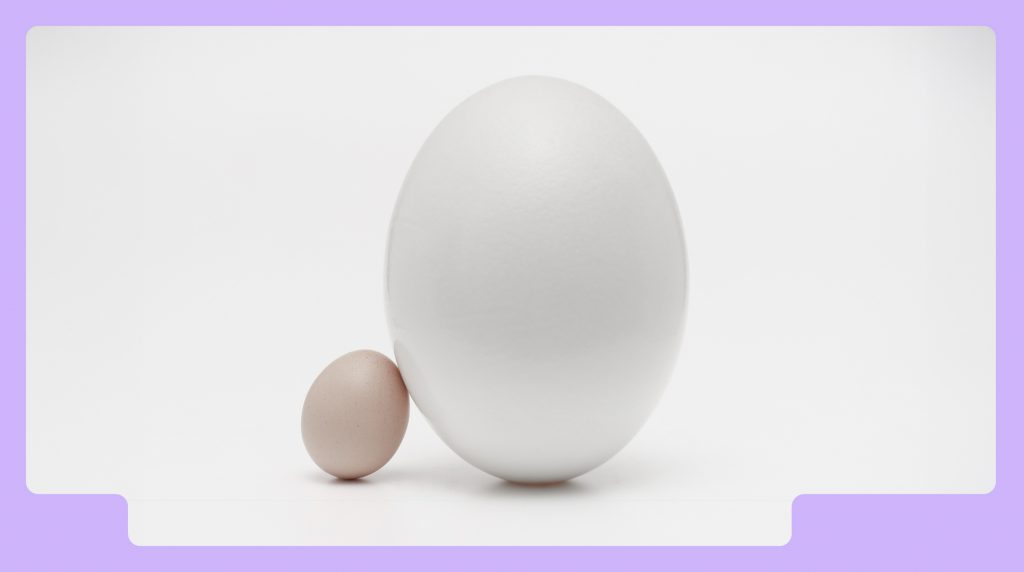

Small-cap and large-cap are terms used to classify companies based on their market capitalization. Market capitalization is the total value of a company’s outstanding shares. Here’s the key difference between the two:

What are Small-Cap Stocks?

Small-cap companies have a relatively smaller market capitalization – of less than $2 billion. These companies are often seen as younger or emerging, with lots of growth potential.

Pros of investing in Small-Cap Stocks:

- Growth Potential: Small-cap stocks have more room to grow. Investing early in these companies can yield substantial returns if they succeed.

- Undervalued Gems: Sometimes, smaller companies are overlooked by the market, leading to opportunities for investors to find undervalued stocks.

- Less Competition: Institutional investors often focus on larger companies, so there may be less competition among individual investors in the small-cap space.

Cons of investing in Small-Cap Stocks:

- Higher Risk: Smaller companies are more vulnerable to economic downturns and other challenges. This means higher risk for investors.

- Volatility: Small-cap stocks tend to be more volatile, with prices that can swing significantly in a short period.

What are Large-Cap Stocks?

Large-cap companies are well-established and usually have a larger market capitalization – over $10 billion. They are often considered more stable and less risky.

Pros of investing in Large-Cap Stocks:

- Stability: Large-cap companies are often more stable and less prone to drastic market fluctuations.

- Dividends: Many large-cap companies pay dividends, providing a regular income for investors.

- Liquidity: Large-cap stocks are easier to buy and sell, thanks to their high trading volumes.

Cons of investing in Small-Cap Stocks:

- Slower Growth: These companies have already reached a certain level of maturity, which means their growth potential may be more limited compared to smaller companies.

- Pricey: Large-cap stocks can be expensive to buy on a per-share basis, which might limit the number of shares you can afford.

- Investing with Bamboo and Dollar-Cost Averaging

So where should you invest?

The decision to invest in small-cap or large-cap stocks ultimately depends on your financial goals, risk tolerance, and investment horizon. With apps like Bamboo, you can easily create a diversified portfolio that combines the growth potential of small-cap stocks and the stability of large-cap stocks. Remember that there is no one-size-fits-all answer, and it’s important to do your own research or consult with a financial advisor before making any investment decisions.