Introduction:

Investing in stocks can seem intimidating for beginners, but with the right approach, it can be a rewarding endeavour. One crucial aspect of investing is evaluating the company before deciding to invest in its stocks. In this beginner’s guide, we will explore simple and easy-to-understand steps to evaluate a company and make informed investment decisions.

- Understand the Business:

The first step in evaluating a company is to understand its business. What products or services does the company offer? Who are its competitors? Understanding the industry and the company’s position within it will give you a foundation for analyzing its potential.

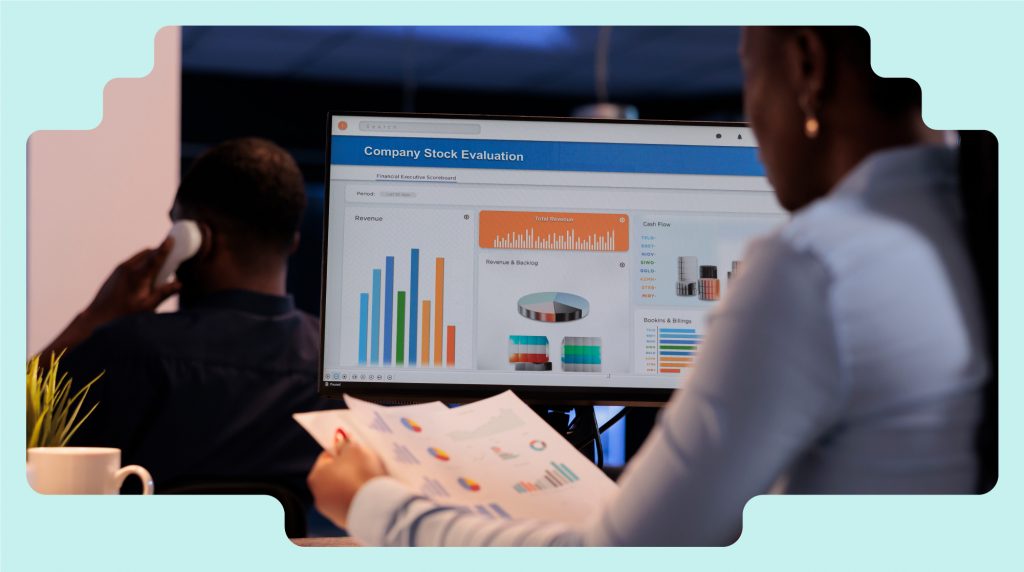

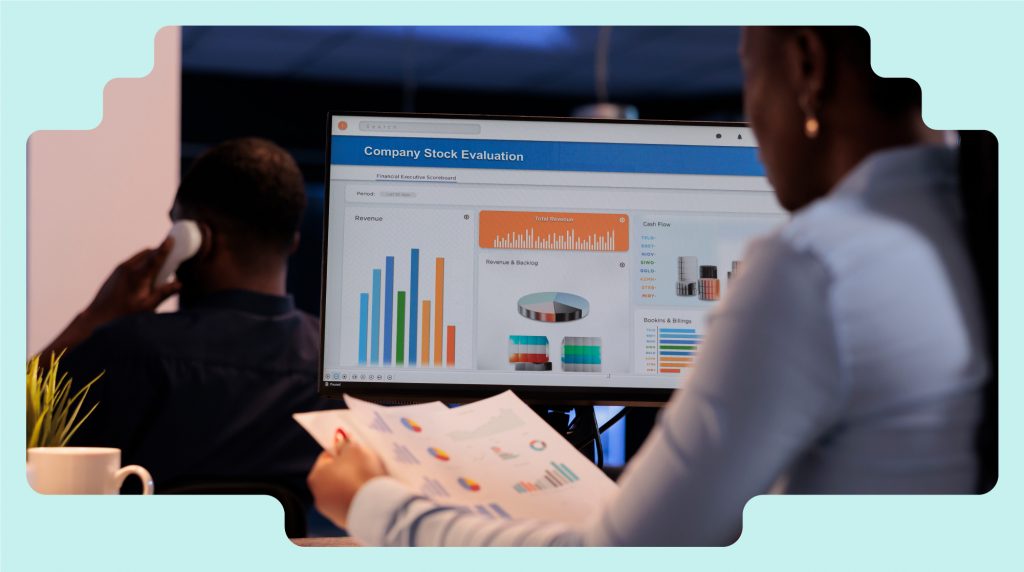

- Review the Financial Statements:

Financial statements provide essential information about a company’s performance. Look for the company’s annual report, which typically includes a balance sheet, income statement, and cash flow statement. Pay attention to key figures such as revenue, expenses, net income, and cash flow. Analyzing these statements will help you gauge the company’s financial health.

- Assess Profitability and Growth:

Evaluate the company’s profitability and growth potential. Look at its historical financial performance, including revenue and net income growth over the years. Additionally, compare the company’s performance to its competitors and the overall industry trends. A consistently profitable and growing company may indicate a strong investment opportunity.

- Analyze the Competitive Advantage:

Consider the company’s competitive advantage or unique selling proposition. Does it have a strong brand, patented technology, or a large customer base? A sustainable competitive advantage can contribute to a company’s long-term success and growth potential.

- Evaluate the Management Team:

Assess the company’s management team and their track record. Look for experienced executives with a history of success in the industry. Check if the management team has a clear vision for the company’s future and if their actions align with shareholders’ interests.

- Study Industry Trends:

Stay updated on industry trends and factors that can impact the company’s performance. Changes in technology, regulations, or consumer preferences can significantly affect a company’s prospects. Analyzing industry trends will help you understand the risks and opportunities associated with your investment.

- Consider the Valuation:

Finally, evaluate the company’s valuation to determine if it is reasonably priced. Compare the company’s current stock price to its earnings (price-to-earnings ratio), book value (price-to-book ratio), and other relevant valuation metrics. A company with a lower valuation relative to its peers or historical averages may present an attractive investment opportunity.

Conclusion:

Evaluating a company before investing in its stocks is an essential step to make informed investment decisions. By understanding the business, reviewing financial statements, assessing profitability and growth, analyzing competitive advantage, evaluating the management team, studying industry trends, and considering the valuation, beginners can gain a solid foundation for evaluating companies. Remember, investing involves risks, so it’s crucial to conduct thorough research and seek advice from financial professionals before making any investment decisions.