You asked and we listened!

We are thrilled to announce that you can now automate recurring stock purchases! Yes, you can now set up daily or monthly automation to buy any stock of your choice. With Recurring Purchases feature, you can take advantage of Dollar Cost Averaging (DCA).

Dollar Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of whether the market is going up or down. This strategy helps you buy more shares when prices are low and fewer shares when prices are high. In simpler terms, it’s like regularly putting a set amount of money into your investment, no matter what’s happening in the market, to help you build your savings over time.

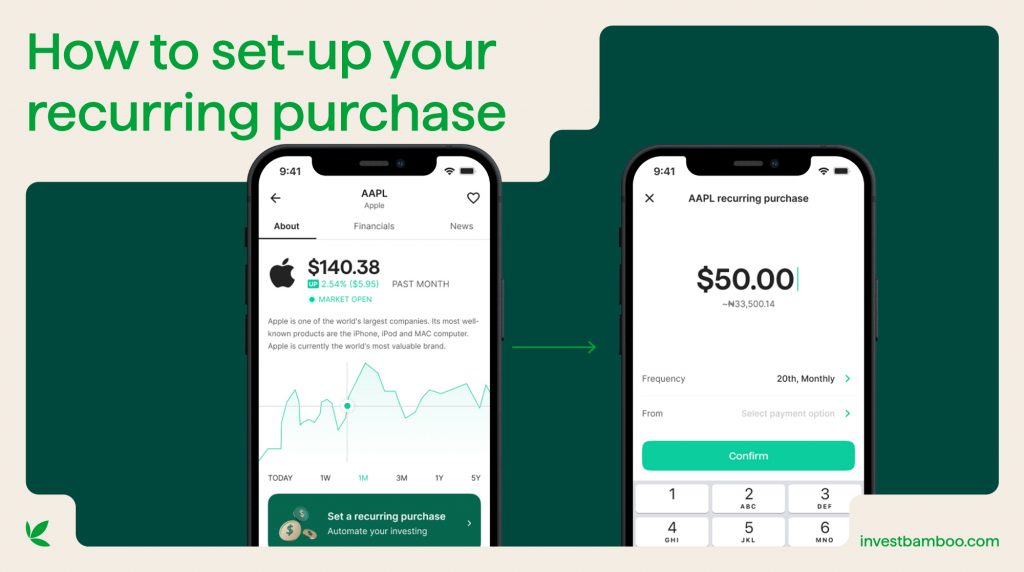

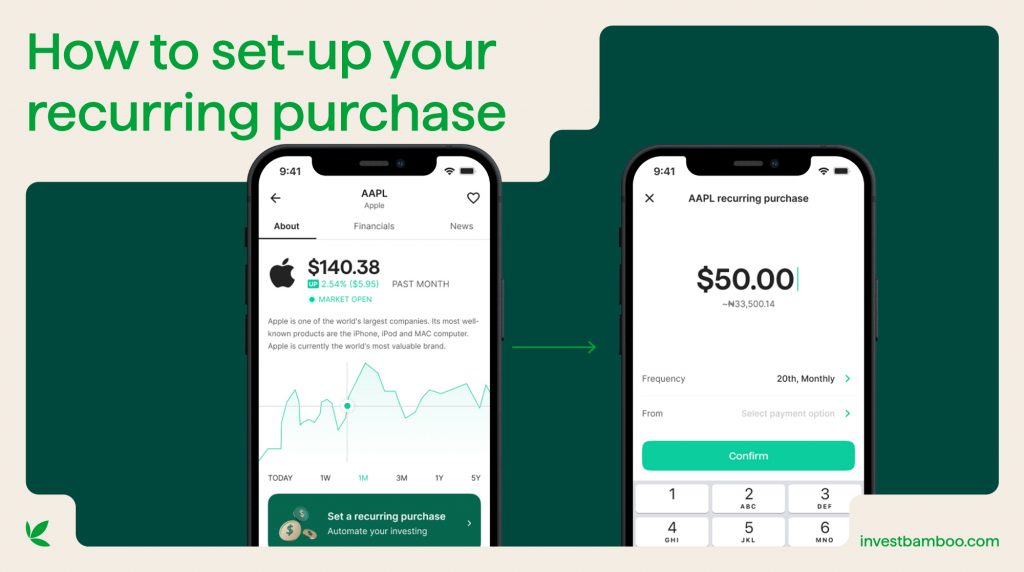

How to set up DCA on Bamboo

- Log into your Bamboo account

- Pick a stock and select “Setup recurring purchases”

- Decide on an amount, and how often you want to invest and

- Viola! Your stock purchases are now automatic!

Here’s how DCA can help you make money on Bamboo.

Let’s say you’re investing $100 every month into a particular stock, and we’ll consider the stock’s price over a period of 5 months:

Month 1: Stock price = $20 per share

Month 2: Stock price = $25 per share

Month 3: Stock price = $18 per share

Month 4: Stock price = $15 per share

Month 5: Stock price = $22 per share

Here’s how your investment would look month by month:

Month 1:

– You invest $100.

– You buy 5 shares ($100 / $20 per share).

Month 2:

– You invest another $100.

– You buy 4 shares ($100 / $25 per share).

Month 3:

– You invest another $100.

– You buy 5.56 shares ($100 / $18 per share).

Month 4:

– You invest another $100.

– You buy 6.67 shares ($100 / $15 per share).

Month 5:

– You invest another $100.

– You buy 4.55 shares ($100 / $22 per share).

Total investment: $500

Total shares purchased: 26.78 shares

Average cost per share = Total investment / Total shares purchased = $500 / 26.78 ≈ $18.65 per share

Now, if you had invested a lump sum of $500 at the beginning when the stock was priced at $20 per share, you would have bought 25 shares ($500 / $20 per share), and your average cost per share would have been $20.

By using dollar-cost averaging, your average cost per share is lower compared to investing a lump sum upfront. This is because you were able to buy more shares when the price was lower and fewer shares when the price was higher. Over time, this approach can help smooth out the effects of market volatility and potentially result in a lower average cost per share.

Keep in mind that dollar-cost averaging does not guarantee profits and won’t eliminate the risks associated with investing. It’s just one strategy to consider based on your investment goals, risk tolerance, and market outlook.

With these few points of mine, I hope I’ve been able to convince you to start making money on Bamboo. Sign up on Bamboo & set up recurring purchases now!

2 Comments

This strategy is very nice.

If one now key in and it becomes authentic and you don’t have money along the line to continue investing what happens??

Secondly, how do I activate this Bamboo DCA since I don’t have Dollar account??

How can I start this Business